Why it matters

Managing money is one of the hardest parts of running a business. In fact, nearly 60% of small business owners say bookkeeping and accounting are their least favourite tasks (Source).

AI can:

- Automatically track expenses and categorise transactions

- Generate invoices and chase payments

- Forecast cash flow based on your real-time data

- Identify cost-saving opportunities

In short, it helps you see what’s really going on - instantly.

How to get started

Here’s a simple roadmap to introduce AI into your financial workflow:

Step 1: Choose an AI bookkeeping tool

Pick a tool that fits your business size and setup.

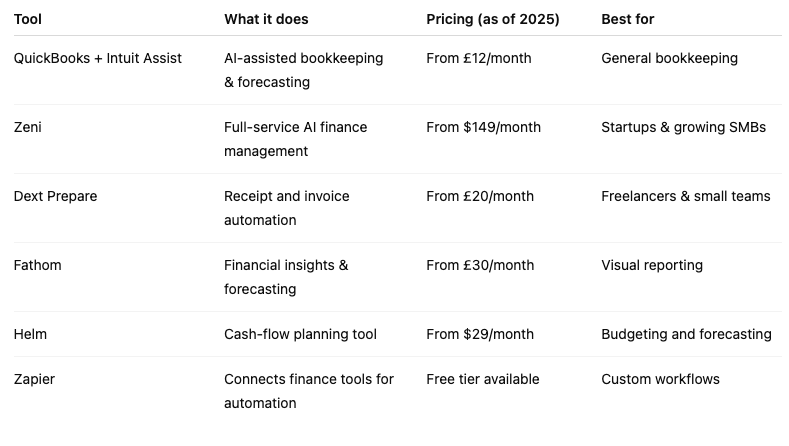

Recommended tools:

- QuickBooks with Intuit Assist – automatically categorises transactions, predicts cash flow, and suggests financial insights.

- Zeni – an AI-first bookkeeping service that gives real-time dashboards and profit snapshots.

- Dext Prepare – scans receipts and invoices to extract data directly into your accounting software.

Step 2: Set up automation for routine tasks

You can link your accounting tool to your payment apps (like Stripe or PayPal) and business bank account. Most AI systems will:

- Record transactions automatically

- Match receipts with expenses

- Send payment reminders for overdue invoices

If you’re using Zapier, you can create a “Zap” that logs new Stripe payments in QuickBooks or Google Sheets - no manual entry needed.

Step 3: Use AI for cash-flow forecasting

Cash flow is what keeps your business alive - but predicting it can be tricky.

AI tools now analyse your transaction history to predict when you might run short or have surplus funds.

Tools that help:

- Fathom – connects to QuickBooks or Xero to visualise trends and forecast scenarios. It combines insightful reporting, fast cash flow forecasting and actionable financial insights into an easy business management solution.

- Helm – offers easy cash-flow planning with AI-assisted projections.

Tip: Check your forecasts weekly, especially if you’re growing fast or have seasonal revenue.

Step 4: Analyse and act on insights

AI tools don’t just report data - they explain it. You’ll start getting prompts like:

“Your expenses this month increased by 15% due to supplier costs. Would you like to compare vendor rates?”

Use these insights to negotiate better deals or adjust pricing.

Tip

Start small. Automate one thing first - like sending invoices or categorising expenses. Once you’re comfortable, expand to forecasting or full automation.

Aimie

Aimie